West Linn facing largest ever deficit in coming years

Published 4:12 pm Friday, June 6, 2025

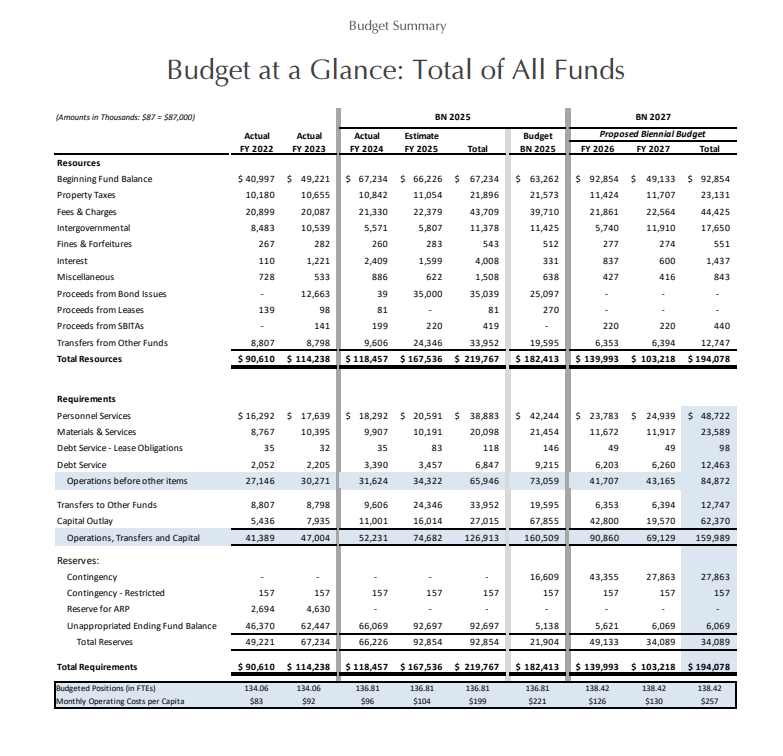

- A snapshot of the city of West Linn's 2026-2027 biennial budget. (Screenshot: city of West Linn)

With the West Linn City Council preparing to adopt the city’s 2026-2027 budget later this month, the local government is facing its largest ever projected deficit. Discussions of the Citizens’ Budget Committee, which wrapped up late last month, indicated a forecasted shortfall of $9 million over the next five years.

In those discussions, city Finance Director Lauren Breithaupt said over the past few budget cycles the city’s projected deficit has come in closer to $2-3 million but the city has always managed to balance the budget before the close of the cycle.

The city manager’s budget message, which opens the 162-page 2026-2027 budget, notes that the projected deficit is based on the most conservative estimates for the coming five years.

“This deficit would occur if conservative revenue forecasts come true, and conservative cost estimates come true, and if we spend all budgeted funds at the same time,” the message reads. “All these things aren’t likely to occur at the same time, but it’s a recurring problem that all of us should be thinking about and taking action to address for the City’s long-term financial stability.”

In light of this deficit, Mayor Rory Bialostosky said it will be important for the community to have a conversation in the coming years about strategic and creative ways to raise revenues.

City Manager John Williams emphasized the city’s uniquely limited revenue sources and pointed to relatively low property tax rate. West Linn residents pay $2.12 per $1,000 of assessed value as a base rate to the city of West Linn. This rate, which was frozen by state law about 30 years ago, is one of the lowest in the Portland metro area.

West Linn residents who own a home with an assessed value of $600,000 pay about $1,493 in property taxes to the city. A home with the same assessed value in Lake Oswego would pay nearly double that amount to the city of Lake Oswego.

Williams emphasized that, in total, only about 13 cents of every property tax dollar West Linn residents pay goes to the city. The budget is also hampered by its limited tax base, Williams noted.

West Linn is a largely residential community with little business or industry paying into the city’s taxes, unlike other nearby communities like Wilsonville, Tualatin and Lake Oswego. The city receives only 6% of its tax revenue from commercial and industrial businesses, and West Linn’s only industrial business, the Willamette Falls Paper Company, recently closed. Wilsonville, for comparison, receives 29% of its tax revenue from commercial and industrial.

New operations center

While the city faces these revenue challenges, it is moving forward with plans to build a new $35 million operations facility. With the current operations building on Norfolk Street undersized and aging, the city’s public works and parks and recreation department have for years stressed the need for a larger, more resilient facility.

The city plans to break ground on the new building in the near future. To pay for the facility, which is located on the hillside above I-205 just off of Salamo Road, the city will use a full faith and credit obligation loan.

Public works analyst Morgan Lovell said the loan will help the city strategically manage the expense of the project over 20 years.

Other than the operations center project, Williams and other staff described the budget as “lean” with several department heads noting they were cautious with funds for the coming biennium.