OPINION: What you should know as West Linn prepares its new budget

Published 11:15 am Tuesday, May 27, 2025

- John Williams

In April I wrote an article that explained the importance of the city of West Linn’s budget and described how it’s put together, reviewed by the community and adopted. Here in Part 2, you’ll find highlights of the draft budget and my thoughts on the city’s overall financial situation.

Here are the top things you should know:

West Linn’s relatively low property taxes are a challenge

I’ll start with the most important fact about property taxes in West Linn that almost no one knows: West Linn receives lower tax revenue per capita than almost any other city in the Portland region. There are two main reasons for this:

- Low tax rate: When Oregon’s property tax system was drastically changed in the 1990s, West Linn’s property tax base rate was permanently frozen at a low level. As a result, a very small share of your tax bill goes to the city of West Linn – less than 13 cents out of each tax dollar. Other cities in our area receive significantly more. As a result, we have fewer employees per capita than other cities in the region and provide fewer services in many areas. (By the way, if you want to check my math on the 13 cents, I made an “Ask The City Manager” video that will show you how. Search online for the videos or go to the city manager section of our website.)

- Less diverse tax base: Cities like Wilsonville, Oregon City, Tualatin, Milwaukie and Lake Oswego have large commercial and industrial districts which provide significant property taxes to supplement those from homes. These areas are valuable and much desired by most communities because they generate taxes and jobs. West Linn has smaller, lower-density commercial areas and very little industrial, so revenues are significantly lower per capita. We receive only 6% of our tax revenue from commercial and industrial while Wilsonville receives 29% from those businesses.

Check our budget document for more data on all this. Property taxes make up about 23% of West Linn’s revenue and represent a major share of flexible funds used for basic general government services (most other revenue comes with restrictions on how that money can be spent), so our low city tax rate has big implications for our financial abilities and staffing levels.

The budget is balanced, but…

The draft two-year budget is balanced, as required by law. However, future years are a concern. Most of the city’s revenue sources are flat or limited in growth, but almost every basic supply, material or contract has gotten more expensive in recent years, just like it has for your household. A few examples: power rates are up about 18%, liability insurance is up about 15% and our PERS costs are increasing by double digits as well.

This trend, combined with our property tax rate, explains why our five-year forecasts don’t look very rosy. We could have real problems if worst-case revenue forecasts and cost estimates come true. These things aren’t likely to occur at the same time, but it’s a scenario that we should be thinking about and taking action to address in the next two years. The City Council and Budget Committee will be talking about all of this in their upcoming meetings.

A few budget highlights

The two-year budget allocates over $160 million and directs the work of approximately 140 employees. Here are a few highlights of interest:

- We hope to break ground this year on a much-needed new City Operations Facility to replace the severely substandard site on Norfolk Street with a safe, environmentally sustainable and efficient facility on Salamo Road. This project is largely funded by our utility rates.

- The West Linn City Council and Transportation Advisory Board are working hard to identify needed pedestrian safety projects city-wide and are reviewing funding options, since we do not have a dedicated source for such projects. Council has made this a priority for 2025-2027.

- We continue to work on identifying funding options for needed upgrades to our drinking water distribution system. Our recent master plan update identified over $100 million in system needs over the next 20 years, far more than existing funding can handle.

- The proposed budget contains no funding for a Community Recreation Center. Staff and community members continue to meet to identify partnerships or grants that could move this project towards reality.

The draft budget is available, and the public adoption process starts now

The draft budget is now available on our website, or you can review printed copies at City Hall and the library. The city’s Budget Committee (mayor, council and five community members) started meeting May 27. All meetings are public, and we encourage in-person, virtual or written comments. Search online for “West Linn Budget Committee” or visit our city meetings page to get details. The City Council will hold hearings and adopt the budget in June.

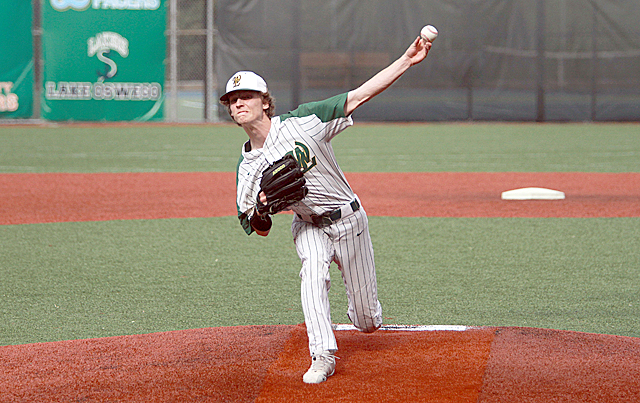

I hope this snapshot has been helpful. Maybe it even whets your appetite to dive into the full budget … or if not, thank you for reading this far. You can go on to the sports section now (go Lions!). Thanks for being part of “One West Linn” with us and have a great day.

John Williams is the West Linn city manager.